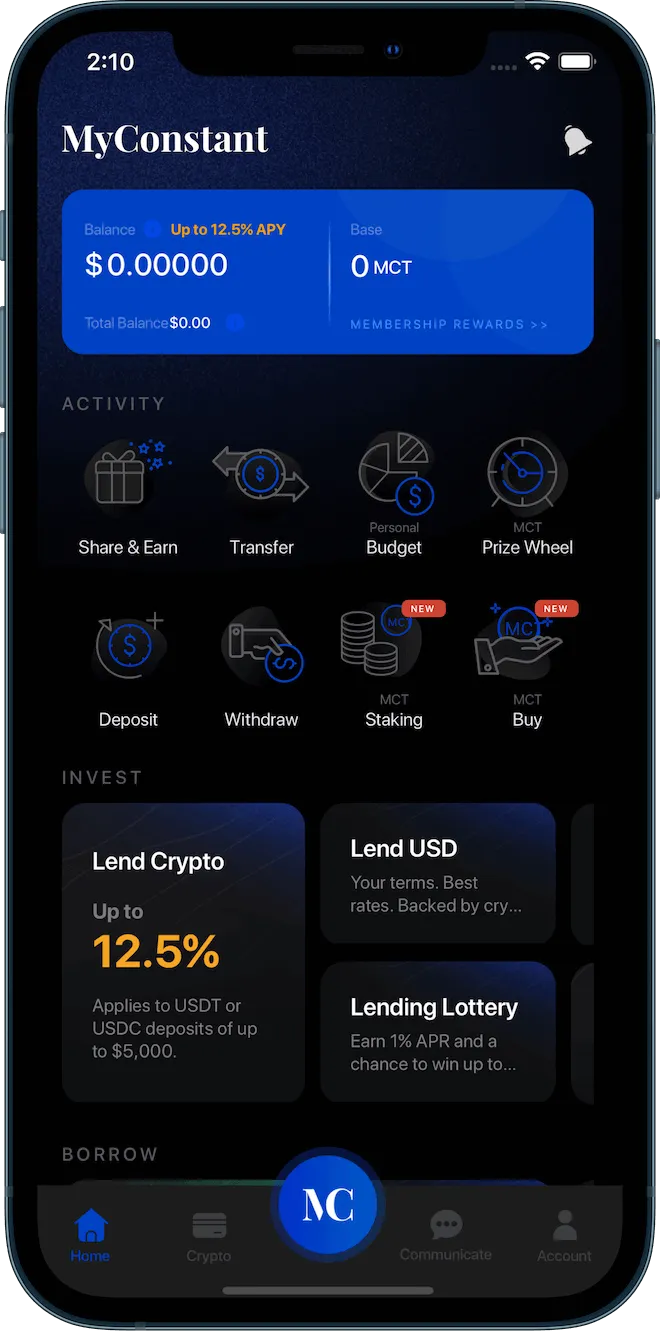

Invest in global peer-to-peer (P2P) lending with USD or crypto.

P2P lending allows you to invest in people and businesses around the world for up to 8% APR. All lending is backed by cryptocurrency collateral. Earn across multiple markets, spreading risk and maximizing reward. No investing fees. Free USD withdrawals. 24-7 customer support.

Or borrow against 0+ cryptocurrencies from just 6% APR. Get the cash or crypto you need instantly without having to sell your portfolio. Your crypto is securely stored and returned to you when you repay.

Cryptocurrency collateral (held by us or liquidity pool partners) helps protect your investment returns from borrower defaults.

Backed by crypto.

and more.

No credit checks.

Why it’s better

MyConstant is designed to protect them both.

Our products and benefits

of our products and benefits.

How MyConstant works

"Where these interests overlap, new DeFi products emerge, such as cryptobacked lending. You invest (U.S. dollars) or a stablecoin in a borrower who stakes cryptocurrency as collateral and in return receive interest," Roper says.

Our Press

Our high-yield, collateral-backed, peer-to-peer investments have gotten a lot of press. Click View press below to find out what finance’s most respected publications think about us.

Frequently

Asked Questions

P2P lending is where one person lends to another in return for interest, without any third party getting in the way. Unlike bank lending, where the bank lends your deposits and keeps the lion’s share of interest, P2P lending lets you keep all the profits yourself.

On our platform, you also have full control over the term with a choice of anytime withdrawals or 1, 3, and 6-month fixed terms. We differ from other P2P lending platforms in all lending is backed by collateral. In other words, we secure loans with assets that can be sold easily (cryptocurrencies).

New to P2P lending? Here’s what to know before you invest.

MyConstant is a collateral-backed peer-to-peer lending platform. Every loan is backed by collateral of up to 200% of the loan amount, which is sold if borrowers default or if its value falls to a threshold, protecting investors (borrowers keep the loan).

Unlike other platforms, MyConstant pools investor funds into a lending pool or reserve. This means you match instantly, whether you’re a borrower or an investor. We don’t do credit checks and investors can choose instant access investing or one of three fixed terms for our best rates.

As well as providing you with a platform on which to do business, we also believe in giving you the educational resources to reach your financial goals, fast. To learn more, check out our blog.

Anyone can participate, as long as you have an internet connection (to use our website) and access to a bank account (to receive a loan or repayment). If you intend to invest fiat (USD), you will also need to pass KYC (Know Your Customer) checks.